Get the Funds You Need

Without the Hassle of Traditional Loans

Boost Your Business Potential with A Revenue Loan

Revenue Loans provide a unique and flexible financing solution for businesses seeking quick access to capital without the lengthy and stringent requirements of traditional loans. With a Revenue Loan, you can receive funds in a matter of days, repayable through a percentage of your future sales, making it an ideal option for businesses with fluctuating revenue.

Introduction to

Revenue Loans

Revenue Loans are a type of financing where a business receives a lump sum of cash in exchange for a percentage of future sales. Unlike traditional loans, they are repaid through a portion of your daily transactions, offering flexibility and ease in managing repayments.

-

Definition of Revenue Loan:

A Revenue Loan is an advance on future sales, providing immediate working capital. -

How Revenue Loans Work:

You receive funds quickly and repay through a percentage of daily sales. -

Comparison with Traditional Loans:

Revenue Loans offer faster access to funds and flexible repayment terms compared to conventional loans.

When to Use Revenue Loans

Short-term

capital needs

Cover immediate expenses without waiting weeks for loan approval.

Seasonal

businesses

Manage cash flow during peak and off-peak seasons seamlessly.

Expanding

inventory

Quickly acquire new stock to meet demand without depleting your reserves.

Managing cash

flow gaps

Smooth out cash flow fluctuations due to irregular income streams.

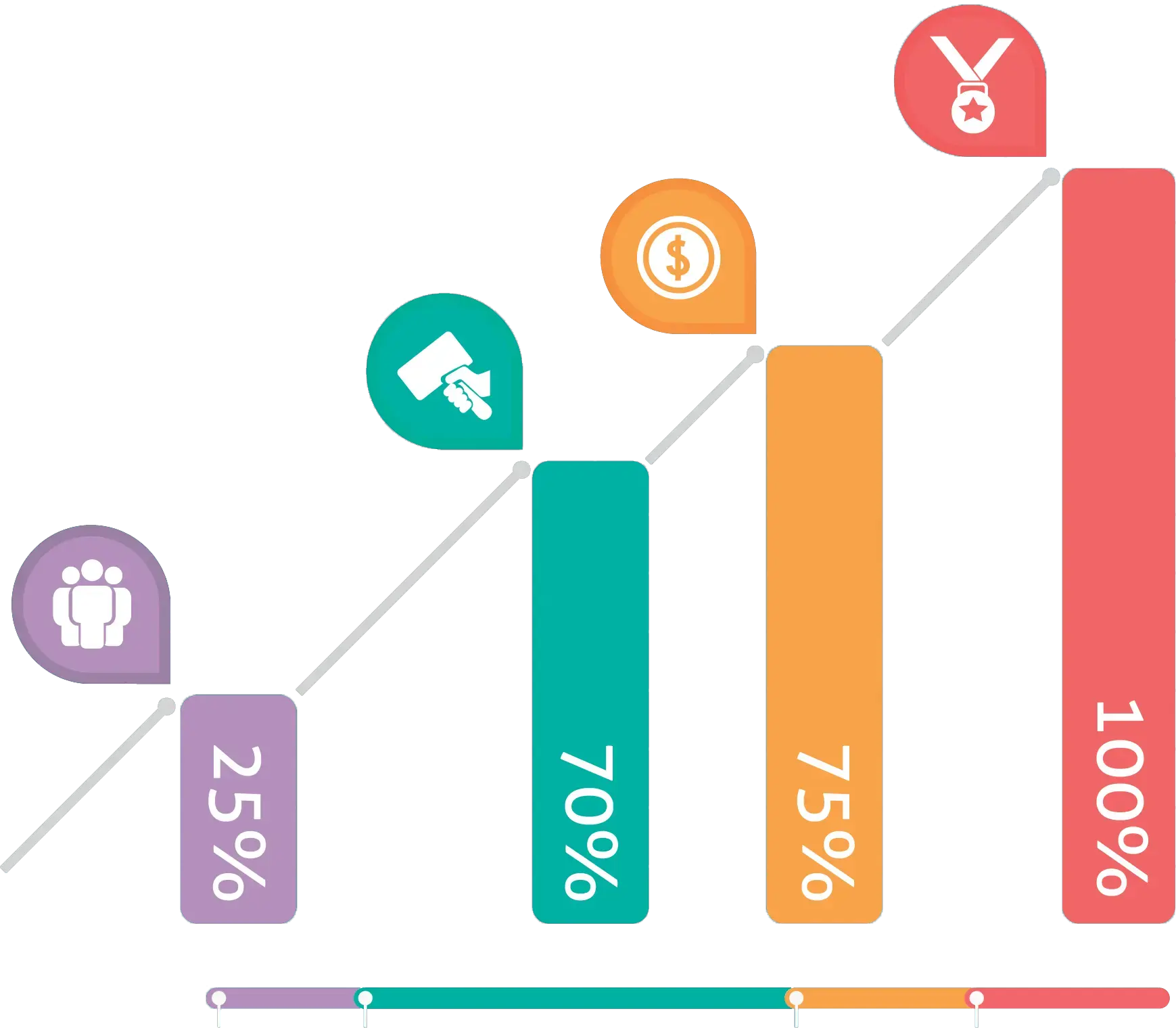

Benefits of Revenue Loans

Speed of

obtaining funds

Receive funds within days, not weeks

Flexibility in

use of funds

Use the advance for any business need, from marketing to inventory.

Minimal credit

score requirements

Approval focuses on sales, not credit score.

Simple

application process

Streamlined and hassle-free application, making it accessible to more businesses.

Why Choose A

Revenue Loan

Revenue Loans offer numerous advantages over other financing options:

-

No collateral required:

Unsecured Financing Means You Don't Risk Your Assets. -

Flexible Repayment Terms:

Repay based on your sales, easing the financial burden during slow periods. -

Fast Approval Process:

Get funds quickly to capitalize on opportunities. -

High approval rates:

Easier qualification criteria compared to traditional loans.